Federal Work-Study jobs help students earn money to pay for college or career school.

If you’re staring at your college or career school costs and thinking, “I need a way to earn money without wrecking my schedule,” you’re exactly who Federal Work-Study was built for.

Advertising

It’s not a magic coupon that makes tuition disappear overnight.

But it can be a steady, realistic way to earn income, build experience, and keep your focus on graduating.

This guide is informational only.

We are not affiliated with, endorsed by, or connected to the US Department of Education, your school, or any employer mentioned.

Rules and school policies can change, and each college or career school runs its program a little differently, so always confirm details with your financial aid office.

What Federal Work-Study is and why it exists

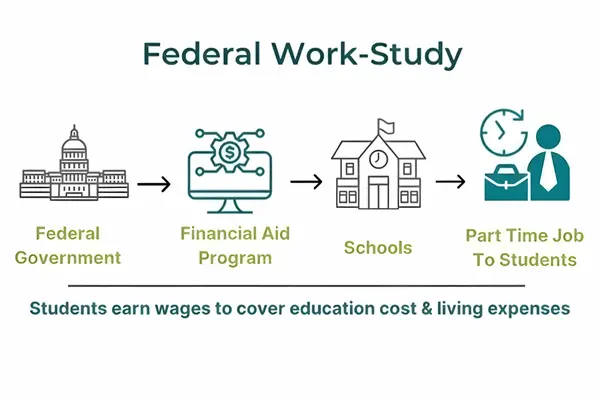

Federal Work-Study is a federal student aid program that provides part-time employment for students who need earnings to help pay for postsecondary education.

The program also encourages participating students to take community service roles when possible.

Instead of borrowing more money, you earn money by working an approved job while you’re enrolled.

And unlike a federal student loan, what you earn through a work-study paycheck is not money you have to pay back.

Federal Work-Study can be available at colleges, career schools, and trade schools that participate.

That last part matters, because participation and funding levels depend on the school.

Federal Work-Study can feel like “aid,” but it works like a job

Work-study is part of your financial aid offer, but you don’t receive it as a lump sum upfront.

You earn it over time by working your scheduled hours.

You typically receive your earnings through a regular paycheck, like any other job.

You’ll be paid at least once a month, and some schools pay weekly or biweekly.

Many schools offer direct deposit, though some may still use paper checks.

Undergraduate students are paid by the hour.

Graduate and professional students may be paid hourly or by salary depending on the position.

Work-study jobs are intended to be part time, and your school will set limits to support your academic progress.

Federal Work-Study vs a regular part-time job

A regular part-time job can be great, but it’s usually built around the employer’s needs first.

A Federal Work-Study job is designed to fit around your class schedule and your role as a student.

Another difference is the “award” structure.

With work-study, your school generally authorizes a maximum amount you can earn for the period, and you typically should not exceed it.

If your work-study funding runs out, continuing in the same role may or may not be possible, and that depends on the employer and the school.

Also, work-study roles can be on campus or off campus, including nonprofit community-based roles, which can be a strong resume builder.

Who can get Federal Work-Study

To be eligible for a Federal Work-Study job, you must meet general federal student aid eligibility and you must have financial need.

Your school’s financial aid office makes the final determination and cannot award work-study in a way that exceeds your financial need when combined with other resources.

You also have to keep meeting your school’s standards for satisfactory academic progress to stay eligible.

And here’s the part students often miss: you can do everything “right” and still not receive work-study, because funding and jobs can be limited.

Schools are required to make work-study reasonably available to eligible students to the extent funds are available, and they must use written, uniformly applied selection procedures.

So if you want the best shot, timing and follow-through matter.

How Federal Work-Study awards are decided

A work-study offer can depend on your financial need, whether you received work-study in a prior year, and how much funding your school has available that year.

Even if you received it last year, funding and awards are not guaranteed each year.

Some students assume they can “swap” work-study dollars directly for tuition dollars on day one.

In reality, work-study is commonly most useful for day-to-day expenses like food, transportation, and supplies, because you earn the money throughout the term.

Some schools may allow you to apply work-study earnings to billed expenses like tuition or fees, but that is a school policy question.

How to apply for Federal Work-Study

You can’t get work-study without doing the first step, even if you’re sure you qualify.

Step-by-step: the simplest path to Federal Work-Study

- Submit the FAFSA as early as you can for the year you’re requesting aid.

- Review your financial aid offer from your school to see whether Federal Work-Study is included.

- Accept the work-study portion in your aid offer if your school requires acceptance before job placement.

- Contact your school’s financial aid office or student employment office for the exact next steps and job access instructions.

- Start your job search early, because jobs can be limited and hiring can take time.

- Apply, interview, and complete any onboarding steps your school requires before you start working.

Filing early can matter, because students who file the FAFSA early can have a better chance of being awarded limited work-study funds.

Where you can work with Federal Work-Study

Many work-study jobs are on campus, which can be a huge win for commuting time and flexibility.

But not all work-study jobs are on campus.

Some students work off campus in approved nonprofit or community-based roles, like tutoring or other community service work.

From the program administration side, schools have community service requirements tied to how work-study funds are used, and community service employers generally must be nonprofit or governmental, not private for-profit organizations.

In a normal year, schools must use at least 7% of their Federal Work-Study allocation for community service jobs, and they must have at least one work-study student in a reading tutor or family literacy role, unless a waiver applies.

You do not need to memorize these rules.

You just need to know they exist, because they explain why your school might strongly promote tutoring, literacy, public service, and similar roles.

Pay, wages, and what “you earn” really means

Work-study pay must follow wage laws.

Federal Work-Study students must be paid at least the federal minimum wage, and they must also meet any state or local minimum wage requirements if those are higher.

A training wage that is below minimum wage is not permitted for Federal Work-Study jobs.

Your exact pay rate can vary by job and by the skills required.

And your total earnings are limited by the award amount and the hours your school authorizes, so it helps to track your earnings and hours from the first week.

Federal Work-Study in the summer or between terms

Many students assume work-study only exists during fall and spring.

But a student can be employed in a Federal Work-Study job during a period of nonattendance, such as a summer term, including a summer term before the student begins attendance for the first time.

There are conditions, like planning to attend the next enrollment period and having financial need for that upcoming period.

This is a great conversation to have early with your financial aid office, because summer work-study can be limited and is handled differently by different schools.

Does Federal Work-Study affect your future financial aid

This is one of the most reassuring parts of the program.

Work-study earnings are not counted as part of your total income when your school calculates your aid offer for the next year.

In the Student Aid Index methodology, Federal Work-Study is treated as an income offset, which supports the idea that it should not reduce future aid in the same way as other earnings.

Beginning with the 2024–25 award year, schools report Federal Work-Study earnings by individual earners to the Department of Education, and the Department uses that information to report Federal Work-Study on the individual earner’s FAFSA.

In plain English, work-study is designed so you can work and still be considered fairly for aid.

Smart ways to use Federal Work-Study money without stress

If you’re depending on work-study to help you get through the semester, the key is matching your expectations to the paycheck rhythm.

You are earning money over time, not receiving a one-time payout.

So the best strategy is to assign your work-study earnings to the kinds of costs that show up every week.

Good uses for work-study pay

- Groceries and meal costs that hit weekly.

- Transportation, gas, transit passes, and rideshare backup.

- School supplies and required materials you can’t delay.

- A small emergency buffer so one surprise expense doesn’t derail your month.

If your school allows applying earnings to billed expenses like tuition or fees, that can be an option, but it is not automatic everywhere.

Federal Work-Study: how to get the most value beyond the paycheck

A work-study job can be more than “just a campus job.”

It can be a low-pressure way to build experience, references, and momentum while you’re still in school.

Practical tips students wish they heard sooner

- Pick a role that matches your schedule first, and your resume second.

- Communicate early if your class schedule changes, because your employer plans hours around your school schedule.

- Track your hours and your remaining award so you do not accidentally exceed your limit.

- Ask what “success” looks like in the role in the first week, so you can shine without guessing.

- Keep your grades up, because falling below your school’s satisfactory academic progress requirements can affect your eligibility.

- If you want community-impact experience, ask about nonprofit community service openings early, because those roles may be in demand.

Common questions about Federal Work-Study

Is Federal Work-Study guaranteed if I qualify

No, it is not guaranteed each year.

Awards can depend on your financial need, prior work-study history, and how much funding your school has available.

Jobs can also be limited, so timing matters.

Do I automatically get placed into a job

Not always.

Some schools may match students to jobs, but many require you to find, apply, and interview for work-study positions.

Your financial aid office and student employment center are usually the best starting points for the official process.

Can Federal Work-Study help with tuition

It can help you afford school overall, because it provides earnings that can reduce what you need to borrow.

But it is usually earned gradually and commonly used for day-to-day expenses.

Some schools may allow you to apply earnings to your student account for billed charges, and that’s a school-specific policy.

How often will I get paid

You will typically receive pay through a regular paycheck at least once a month, though some schools pay weekly or biweekly.

Will I lose financial aid next year if I work

Work-study earnings are not included as part of your total income when your school calculates your next aid offer.

Work-study is also treated as an income offset in the aid calculation process.

Can I work off campus

Yes, some Federal Work-Study jobs are off campus, including nonprofit community-based work.

Community service roles generally must be with qualifying nonprofit or government organizations, and schools must also inform students about community service opportunities.

What if my work-study funds run out

You generally should not exceed the total hours authorized for your work-study job, and you should talk with your supervisor and financial aid office if you have questions about your limit.

In some cases, a student may be able to continue as a regular employee after work-study funding runs out, but that is not guaranteed.

A quick reality check that saves a lot of frustration

Federal Work-Study is not “free money.”

It is earned income through part-time work, structured to support your education.

If you treat it like a plan instead of a surprise, it can make your semester feel dramatically more manageable.

File the FAFSA early, follow your school’s instructions, and start your search before the best roles get snapped up.

And when you’re unsure, go straight to your school’s financial aid office, because they control the details that matter most for your situation.